Nonprofit organizations, such as charities, are allowed to make telemarketing calls even if your number is on the National Do Not Call Registry. Why? U.S. laws like the Telephone Consumer Protection Act (TCPA) grant nonprofits specific exemptions. These rules are designed to balance consumer privacy with the need for nonprofits to reach donors and supporters.

Here’s what you should know:

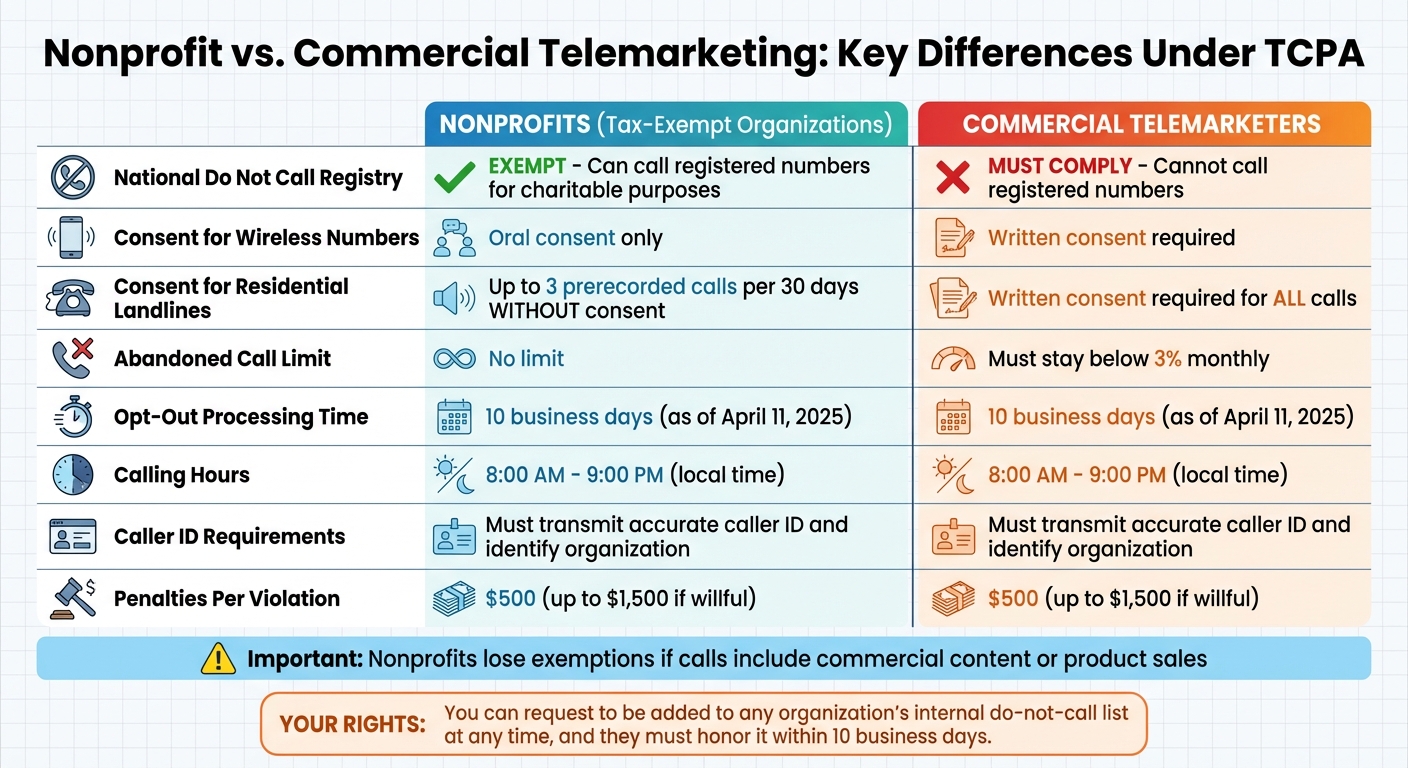

- Nonprofits are exempt from some TCPA rules, including the National Do Not Call Registry. They can call registered numbers for charitable purposes.

- Consent rules are more lenient for nonprofits. For example, they can call residential landlines without prior consent and only need oral consent for wireless numbers.

- Opt-out requests must be honored. If you ask a nonprofit to stop calling, they must add your number to their internal do-not-call list within 10 business days.

- Robocalls are allowed but limited. Nonprofits can send up to three prerecorded calls to a residential number within 30 days without prior consent.

- For-profit fundraisers working for nonprofits are subject to stricter rules, like disclosing the charity’s name and how donations are used.

While nonprofits benefit from these exemptions, they must still follow rules like honoring opt-out requests, providing clear caller identification, and limiting call times to 8:00 a.m.–9:00 p.m. Violations can result in fines ranging from $500 to $1,500 per infraction.

If you want to stop receiving calls, ask to be placed on the charity’s internal do-not-call list. You can also report violations to the FCC or FTC. Understanding these exemptions helps you manage unwanted calls and protect your rights.

Nonprofit vs Commercial Telemarketing Rules Under TCPA

What Is TCPA Compliance? – SecurityFirstCorp.com

What Is the Telephone Consumer Protection Act (TCPA)?

The Telephone Consumer Protection Act (TCPA) is the main federal law that regulates telemarketing practices in the United States. Passed in 1991, its purpose is to safeguard consumer privacy by restricting unwanted telemarketing calls, faxes, and text messages. It lays out the fundamental rules for telemarketing, including specific exemptions for certain organizations, such as nonprofits, that operate under different guidelines.

At its core, the TCPA prohibits the use of automated dialing systems, prerecorded or artificial voice messages, and unsolicited faxes. These restrictions apply across various communication methods, including voice calls, VoIP, and SMS. One of the law’s standout features is that intent doesn’t matter – violations can lead to penalties even if the caller acted in good faith. Additionally, the TCPA empowers consumers to take legal action, either individually or as part of a class action, without waiting for government intervention. This private right of action has led to a significant number of lawsuits.

The penalties for violating the TCPA are no small matter. Fines can reach up to $500 per violation, with willful breaches potentially tripling the damages to $1,500 per violation. Cases involving violations of the National Do Not Call list can lead to even higher penalties.

Recent changes have updated the law to address modern communication practices. For example, the 2019 TRACED Act and new FCC rules (effective April 11, 2025) require telemarketers to honor opt-out requests, like texting "STOP" or "QUIT", within 10 business days. These updates aim to make it easier for consumers to manage their communication preferences.

Main Rules Under the TCPA

The Telephone Consumer Protection Act (TCPA) lays down clear guidelines for telemarketing practices, particularly targeting robocalls and automated messages. Telemarketers are prohibited from using autodialers or prerecorded voice messages to contact cell phones via calls or texts without obtaining prior express written consent. This rule also extends to robocalls made to residential landlines.

The National Do Not Call Registry, introduced in 2003, offers consumers a simple way to opt out of telemarketing calls. By registering your home or mobile number at donotcall.gov, telemarketers are legally required to stop calling within 31 days. Registration is permanent, meaning it doesn’t expire, and telemarketers must update their call lists against the registry every 31 days to stay compliant. While these rules primarily address commercial telemarketers, nonprofit organizations follow slightly different consent guidelines.

The TCPA also enforces strict operational standards. Telemarketing calls are only allowed between 8:00 AM and 9:00 PM local time. Additionally, each call must include proper identification of the caller and their organization. Companies are required to maintain internal do-not-call lists, honor opt-out requests within 30 days, and keep these records for five years.

For automated campaigns, specific rules ensure compliance. If a live agent doesn’t connect within two seconds of a call being answered, the call is considered abandoned, and the abandonment rate must stay below 3% on a monthly basis. Every prerecorded message must also include an opt-out option within the first two seconds. These operational limits set the stage for understanding how nonprofits operate under the TCPA, as they often benefit from certain exemptions.

Violations of these rules come with financial consequences, starting at $500 per infraction, which can escalate to $1,500 per violation if proven intentional.

How Nonprofits Are Exempt from TCPA Rules

Nonprofits enjoy certain leniencies under TCPA rules, especially when it comes to charitable solicitations. These relaxed rules make it easier for tax-exempt organizations to connect with donors without facing the same consent requirements as commercial entities.

One major benefit involves the National Do Not Call Registry. Unlike commercial telemarketers, who risk penalties for contacting numbers on the registry, tax-exempt nonprofits are allowed to call anyone listed when the purpose is charitable solicitation. This exemption also extends to fundraising firms working exclusively on behalf of a nonprofit, as long as the calls remain focused on fundraising efforts.

Consent requirements also differ significantly. For wireless numbers, nonprofits only need oral consent, while for-profit organizations must secure written consent. When it comes to residential landlines, nonprofits can send up to three prerecorded messages within a 30-day period without any consent. In contrast, commercial entities must obtain written consent for every call. These differences lower the barriers for nonprofits to reach out to potential donors.

Another advantage is that nonprofits are not bound by the 3% abandoned call limit imposed on commercial telemarketers. This provides greater flexibility in their outreach efforts.

That said, these exemptions come with strict conditions. The organization must maintain valid tax-exempt status, and the calls must solely aim to solicit charitable donations. If a call promotes the sale of goods or services or includes commercial content from a for-profit partner, the nonprofit loses its exemptions and must comply with the stricter rules for commercial callers, such as obtaining written consent. These safeguards ensure nonprofits can operate effectively while still respecting consumer rights.

Do Not Call Registry Exemption

The National Do Not Call Registry was designed to protect consumers from unwanted sales calls. However, nonprofits are not bound by these restrictions. Fundraisers working on behalf of charities can legally call numbers listed on the registry, as long as the purpose of the call is strictly to request charitable donations. This carve-out highlights the different rules that apply to nonprofit organizations.

"One exception allows for-profit fundraisers to call you on behalf of charities even if your telephone number is listed on the Do Not Call Registry." – Colleen Tressler, FTC

It’s important to note that this exemption only applies when the calls are purely focused on soliciting donations for charities. If the call includes any commercial content or partnerships that promote products or services alongside the charitable appeal, the exemption no longer applies.

Even though nonprofits are exempt from the national registry rules, they are still required to honor opt-out requests made directly to them. If you ask a charity to stop calling, they must add your number to their internal do-not-call list. Under the Telephone Consumer Protection Act (TCPA), charities must process and honor these opt-out requests within 10 business days. This rule ensures that consumers retain control over unwanted calls, as discussed further in later sections.

The enforcement of these regulations is taken seriously. For example, in June 2022, the FTC reached a settlement with InfoCision, Inc., a professional fundraising company, after discovering that the company misled consumers. InfoCision began calls by stating they were not seeking donations, only to request contributions later in the conversation. As part of the settlement, InfoCision paid $250,000 in civil penalties.

Prior Consent Exemption

The TCPA has different consent rules for nonprofits depending on whether they are contacting residential landlines or wireless numbers. Here’s how these distinctions play out:

For residential landlines, nonprofits are allowed to make prerecorded voice calls (robocalls) without needing prior consent. However, there’s a limit – they can’t place more than three calls to the same residential number within a 30-day period. Essentially, this means charities can use automated messages to connect with landline users, provided they adhere to this call frequency cap.

For wireless numbers, the requirements are stricter. Nonprofits must obtain prior express consent before making calls or sending texts, but this consent doesn’t have to be in writing – it can be given orally. This allows nonprofits to secure permission through a phone conversation, an in-person discussion, or any verbal agreement, without needing formal documentation.

"Regarding wireless numbers, any call or text by or on behalf of a tax-exempt nonprofit… is exempt only from the ‘written’ part of the prior express consent provision of the TCPA." – CharityWatch

These rules also extend to professional fundraisers working on behalf of nonprofits. As long as the calls are strictly for charitable solicitation, the same exemptions apply. However, when a nonprofit is involved in a co-venture that includes commercial content, prior express written consent becomes mandatory.

Prerecorded Message Exemption

Nonprofits enjoy a specific exemption when using prerecorded messages for residential landlines. Unlike commercial telemarketers, tax-exempt organizations can send automated voice messages without needing prior express written consent. However, this privilege comes with strict rules to prevent overuse and protect consumers from excessive robocalls.

The key restriction is the three-call limit: nonprofits can only make three prerecorded calls to the same residential number within any 30-day period. If they wish to exceed this limit, they must secure the recipient’s prior express consent beforehand.

Each prerecorded message must clearly identify the organization at the start of the call. Within two seconds of this identification, the message must also provide an interactive, automated opt-out option, such as "Press 1 to stop calls". For calls that go to voicemail or an answering machine, the message must include a toll-free number that connects to an automated opt-out system.

"Nonprofits using robocalls should also be aware that such calls must clearly identify the sponsoring organization at the beginning of the call, must include the organization’s telephone number or address in the message, and must provide a means of opting out of receiving future calls." – Whiteford, Taylor & Preston LLP

This system aligns with federal consumer protection measures, balancing nonprofits’ needs with safeguards for individuals. Nonprofits are also exempt from the abandoned call rules that apply to commercial telemarketers, which limit their abandonment rate to 3%. However, nonprofits must honor opt-out requests within 10 business days and restrict calls to the hours of 8:00 a.m. to 9:00 p.m. local time. This framework provides flexibility while ensuring respect for consumer preferences.

How the Telemarketing Sales Rule (TSR) Applies to Nonprofits

The TSR draws a clear line between telemarketing done directly by nonprofits and that conducted by for-profit telemarketers. Nonprofits that handle their own telemarketing are typically outside the Federal Trade Commission’s jurisdiction, meaning they’re not bound by the TSR. However, the USA PATRIOT Act of 2001 changed the game for for-profit telemarketers – commonly known as telefunders – who solicit donations on behalf of nonprofits, bringing them under the Rule’s umbrella.

"Although tax exempt non-profit charities that conduct their own telemarketing are not covered by the TSR, the USA PATRIOT Act, passed in 2001, brought charitable solicitations by for-profit telemarketers within the scope of the TSR." – Federal Trade Commission

This creates a stricter framework for nonprofits that outsource telemarketing. When a nonprofit hires a for-profit telemarketer, that telefunding firm is required to:

- Clearly disclose the purpose of the call.

- Provide the charity’s name and address.

- Confirm whether donations are tax-deductible.

- Reveal the percentage of contributions that will actually go to the charity.

- Avoid any false or misleading statements.

These rules establish a two-tiered approach to regulation. Nonprofits conducting their own telemarketing enjoy broad exemptions, but telefunders face tighter oversight. For example, while telefunders don’t need to scrub their call lists against the National Do Not Call Registry when working on behalf of a charity, they must honor specific requests from individuals who’ve asked that charity to stop calling. Additionally, telefunders are prohibited from cold-calling people who aren’t already donors or members, must keep records of their activities for 24 months, and can only call between 8:00 a.m. and 9:00 p.m. local time. If a telefunding call shifts to selling a product after discussing a donation, the call immediately falls under regular TSR rules for for-profit businesses.

This dual system strikes a balance: nonprofits running their own telemarketing operations enjoy more freedom, while those outsourcing to professional telefunders face stricter rules aimed at curbing deceptive practices.

sbb-itb-a8d93e1

Rules Nonprofits Must Still Follow

Even though nonprofits enjoy certain exemptions, they must still comply with several telemarketing rules outlined by the TCPA and FCC. These regulations ensure fair practices and protect recipients from unwanted communication.

Calling hours are limited. Nonprofits can only make calls between 8:00 a.m. and 9:00 p.m. local time for the recipient.

Internal Do Not Call (DNC) lists are required. While nonprofits are not obligated to check the National DNC Registry, they must maintain their own internal DNC lists. If someone requests not to be called again, the organization must document the request and refrain from contacting that number in the future. This rule applies regardless of prior donations or volunteer involvement.

Caller ID transparency is essential. Nonprofits are required to transmit accurate caller ID information, including a valid telephone number and, if possible, the organization’s name. For prerecorded messages, the organization must identify itself at the start and provide a callback number for DNC requests.

Limits on prerecorded calls without consent. Nonprofits are allowed to make up to three prerecorded calls to a single residential line within any 30-day period without prior consent. Each message must include an automated opt-out option – such as a keypress or voice command – within the first two seconds. For autodialed calls or texts to cellphones, prior express consent is mandatory.

Opt-Out Requirements

Nonprofits must provide clear and easy ways for individuals to opt out of receiving calls and texts. Starting April 11, 2025, organizations must process opt-out requests and remove phone numbers from their contact lists within 10 business days – a sharp reduction from the previous 30-day timeframe.

Recipients can opt out through several methods: replying to texts, sending an email, leaving a voicemail, or making a verbal request. For text messages, nonprofits must recognize specific keywords like "STOP", "QUIT", "END", "CANCEL," or "UNSUBSCRIBE". After receiving an opt-out request, organizations are allowed to send a single confirmation text within five minutes. However, this message cannot include any promotional content.

For prerecorded robocalls, nonprofits must include an interactive opt-out option – such as a keypress or voice command – at the start of the message, enabling recipients to immediately opt out.

"The old 30-day buffer is gone. You now have 10 business days to remove a consumer from your contact list (phone, text) after they revoke consent." – ActiveProspect

To avoid accidental contact, nonprofits should maintain a centralized do-not-call list. This ensures that all departments or third-party telefunders honor opt-out requests. Non-compliance can result in TCPA penalties ranging from $500 to $1,500 per violation. These updated requirements give individuals greater control over telemarketing communications.

Caller Identification Requirements

Caller identification is a key part of maintaining transparency and adhering to the rules set by the TCPA and TSR. Nonprofits, along with any telemarketers they employ, are required to clearly identify themselves during every call. Federal law mandates that callers must transmit accurate caller ID details, including their phone number and, if available, their name, to any caller identification service. Deliberately blocking or spoofing caller ID information is strictly forbidden.

At the start of each call, the caller must explicitly state that the purpose of the call is to solicit a charitable contribution and name the specific charitable organization they represent. The TCPA also requires callers to provide their own name, the name of the entity they are representing, and a phone number or address where they can be contacted.

"Any person engaged in telemarketing for the solicitation of charitable contributions, donations, or gifts of money or any other thing of value, shall promptly and clearly disclose to the person receiving the call that the purpose of the call is to solicit charitable contributions, donations, or gifts, and make such other disclosures as the Commission considers appropriate, including the name and mailing address of the charitable organization on behalf of which the solicitation is made." – 15 U.S. Code § 6102

These initial identification steps pave the way for additional required disclosures if the recipient requests more details. Upon such a request, telemarketers must immediately provide the organization’s mailing address, clearly explain its mission, confirm whether contributions are tax-deductible, and detail how donations are allocated. Any inaccuracies or misrepresentations in these disclosures violate the Telemarketing Sales Rule.

These identification rules apply universally to all solicitors, whether the nonprofit makes the calls directly or employs third-party telemarketers. Third-party telemarketers are held to the same standards, ensuring that call recipients always know who is calling and the purpose of the call.

What Consumers Can Do About Nonprofit Telemarketing

Even though nonprofits are allowed to call numbers on the registry, you can reduce unwanted calls by asking to be added to their internal do-not-call list. During the call, clearly state, "Please put me on your internal do-not-call list for this charity." Once you make this request, the fundraiser is legally barred from calling you again on behalf of that charity. As Colleen Tressler from the FTC explains:

"They [charitable fundraisers] also can’t call you again if you tell them that you don’t want any more calls from that charity."

Taking this step ensures your preferences are respected, even with existing exemptions.

It’s also important to pay attention to proper call disclosures. Under the TCPA, callers must identify the charity and explain the purpose of the call. If they fail to provide this information or misrepresent tax benefits or how funds are used, you should end the call and report the issue. Additionally, for-profit fundraisers representing charities are not allowed to call before 8:00 a.m. or after 9:00 p.m., and they cannot use robocalls unless you’ve previously supported the charity.

While registering with the National Do Not Call Registry at DoNotCall.gov or by calling 1-888-382-1222 can reduce many telemarketing calls, charity-related calls may still come through.

If you’re unsure about a charity’s legitimacy, ask the caller to send written information rather than making a decision on the spot. This gives you time to research the organization and decide if you want to contribute. These steps help you maintain control and protect your rights. For repeated violations – such as calls after you’ve opted out or misleading information – file a complaint with the FCC or at DoNotCall.gov.

For persistent issues, platforms like ReportTelemarketer.com can assist in stopping unwanted calls. They investigate telemarketers, identify violations of consumer protection laws, and take action, such as sending cease-and-desist letters or filing complaints. This service is free for users, with legal fees recovered from telemarketers when possible.

How to Report Telemarketing Violations

If a nonprofit or its fundraising partner crosses the line with telemarketing rules, it’s crucial to document every detail of the call. Note the date, exact time, the caller ID number, any callback number provided, and the content of the conversation – especially if the caller left out key information. Save all related records, such as voicemails and texts, as they can serve as evidence. If you asked to be placed on an internal do-not-call list or sent a "STOP" text, make sure to record when and how you did so. Having thorough documentation makes filing a report much easier.

Once you’ve gathered your evidence, it’s time to file your complaint. Here’s how:

- For unwanted calls without monetary loss: Submit your complaint at DoNotCall.gov or call 1-888-382-1222.

- If you lost money or suspect a scam: Use ReportFraud.ftc.gov instead.

The Federal Trade Commission (FTC) relies on these reports to spot trends and take action against illegal telemarketing practices. As the FTC explains:

"The FTC and other law enforcement agencies analyze reports to identify and take action against the people responsible for illegal calls and scams." – Federal Trade Commission

Even if the caller ID seems fake or "spoofed", don’t hesitate to report the call. Investigators often have ways to trace these numbers. Keep in mind, though, that if you’re reporting a violation of the National Do Not Call Registry, you’ll need to wait 31 days after registering your number before filing a complaint.

For ongoing or more complicated cases, you can turn to free services like ReportTelemarketer.com. They specialize in tackling unwanted calls by investigating telemarketers, identifying violations, and taking action. This might include sending cease-and-desist letters or filing formal complaints. The best part? You won’t have to pay out of pocket, as legal fees are often recovered from the telemarketers themselves.

Your Rights as a Consumer

Even though nonprofits often have exemptions under federal telemarketing laws, you still have rights to limit unwanted calls or texts and to hold these organizations accountable. These protections allow you to manage your communication preferences effectively.

You can revoke consent anytime. If you’ve previously agreed to receive calls or texts from a nonprofit, that doesn’t mean you’re stuck. The Federal Communications Commission (FCC) makes it clear:

"Consumers may revoke their consent to receive autodialed or robocalls at any time and by use of any reasonable means".

You can opt out by sending a clear text message or directly asking the caller to add you to their internal do-not-call list. Starting April 11, 2025, nonprofits must honor your request within 10 business days.

Nonprofits must follow specific rules. They are required to identify themselves clearly and can only call during the hours of 8:00 a.m. to 9:00 p.m. If they use prerecorded messages to contact your landline, they’re limited to three calls within a 30-day period. Additionally, all robocalls must include an automated, interactive way for you to opt out.

Violations come with penalties. If a nonprofit violates these rules, they can face fines of $500 per violation. This amount increases to $1,500 if the violation is found to be willful or intentional.

You have options for legal action. The Telephone Consumer Protection Act (TCPA) gives you the right to take legal action directly. You can file a lawsuit in small claims or civil court without waiting for government agencies to step in. To strengthen your case, keep detailed records of any violations. If you need help, ReportTelemarketer.com offers a service to investigate calls, identify violations, and take action on your behalf at no cost to you, with attorney fees covered by the telemarketers.

Conclusion

These rules and consumer rights establish a structured approach to nonprofit telemarketing, ensuring a balance between outreach and consumer protection. Understanding the exemptions for nonprofit telemarketing helps shield you from unwanted calls and potential scams. While nonprofits are largely exempt from the National Do Not Call Registry and some TCPA rules, they are still required to respect your preferences. They must honor specific do-not-call requests, limit calls to the hours between 8:00 a.m. and 9:00 p.m., and provide accurate caller identification.

It’s also crucial to differentiate between nonprofits making calls themselves and for-profit telefunders acting on their behalf. Telefunders are subject to stricter rules under the Telemarketing Sales Rule, which mandates disclosures and requires keeping records for 24 months. This distinction gives you the tools to identify and challenge any violations. Knowing this not only safeguards your rights but also promotes accountability in nonprofit communications.

The TCPA empowers you to address violations, with penalties designed to protect consumers. Keep detailed records of persistent issues, including call logs, text messages, and any proof of consent revocation. Services like ReportTelemarketer.com can assist by investigating your case, identifying violations, and pursuing legal action at no cost to you, as attorney fees are recovered directly from the telemarketers.

The bottom line: nonprofits may have certain exemptions, but they are still accountable for respecting your communication preferences. Stay informed, assert your rights, and take action when necessary to ensure those rights are upheld.

FAQs

How can I stop nonprofit telemarketing calls?

To stop receiving telemarketing calls from nonprofits, you can directly ask them to stop contacting you and request to be added to their internal do-not-call list. Another step you can take is registering your number with the National Do Not Call Registry, which helps reduce telemarketing calls. However, keep in mind that nonprofits are partially exempt from some telemarketing restrictions.

Even with these exemptions, nonprofits must still follow certain rules under the Telephone Consumer Protection Act (TCPA). For example, they cannot use robocalls or prerecorded messages without your prior consent. If you suspect a nonprofit is not following these rules, you have the option to report them and safeguard your rights.

If you’re looking for additional support in reporting unwanted calls or addressing telemarketer violations, platforms like ReportTelemarketer.com can assist in investigating and taking action to put an end to these calls.

What rules must for-profit fundraisers follow when calling for nonprofits?

For-profit fundraisers working on behalf of nonprofits have to follow specific telemarketing laws to ensure honesty and protect consumers. They must clearly state the name of the nonprofit they represent, explain why they’re calling, and provide accurate details about how any donations will be used. Making false or misleading claims – like saying a donation is tax-deductible when it’s not – is strictly forbidden.

There are also rules about when and how they can call. Calls are only allowed between 8 a.m. and 9 p.m., and fundraisers must stop calling if someone requests it. Robocalls or prerecorded messages are only permitted if the recipient has previously supported the nonprofit. Additionally, they must respect the Do Not Call Registry unless the person has given prior consent. These guidelines are in place to help maintain trust and accountability in charitable fundraising.

What happens if a nonprofit breaks telemarketing laws?

Nonprofits that fail to comply with telemarketing laws could face hefty fines. The Telephone Consumer Protection Act (TCPA) imposes penalties of up to $5,000 per violation, with even steeper fines for intentional or willful breaches. These regulations exist to shield consumers from unwanted or disruptive calls, and nonprofits are fully required to adhere to them.